In a recent article, you discovered how to write a profit and loss forecast for a start-up business. Any finance house or bank looking at a lending proposition, cannot make a decision to support a funding request based upon this document alone. The profit and loss forecast will support the story within the business plan, but they will also require more information to understand the movement of cash in your business. That’s where a cash flow forecast comes in.

In a recent article, you discovered how to write a profit and loss forecast for a start-up business. Any finance house or bank looking at a lending proposition, cannot make a decision to support a funding request based upon this document alone. The profit and loss forecast will support the story within the business plan, but they will also require more information to understand the movement of cash in your business. That’s where a cash flow forecast comes in.

What Is A Cash Flow Forecast?

The cash flow forecast is a critical tool and should be used by any size business to understand the movement of cash throughout the year. The forecast allows the business owner to plan ahead and ensure funding is in place long before it is needed. Whilst a start-up business does not have the luxury of planning so far ahead, the cash flow forecast will allow the business owner to clarify whether there will be a funding requirement. Broaching this subject with a lender and providing supporting documentation, where required, will demonstrate a level of professionalism that lenders appreciate. Discover more about eligibility when applying for business finance here.

There is sometimes confusion about the differences between a profit and loss and cash flow forecast, and this is because at times, they can look very similar.

Cash Flow Forecast vs Profit And Loss Forecast – What’s The Difference?

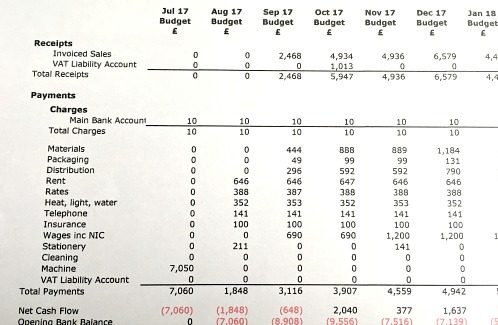

Many of the headings will be the same (see below). So, there will be sales, purchases, direct costs, overheads. If you need a brush up on your terminology, take a look at our jargon busting article on essential accounting terms here. Depending on whether your business is VAT registered, many of the figures can also look the same. However, there are some differences between the two types of forecast…

1. Calculating VAT figures

If we focus on the sales numbers, for a small business that does not register for VAT, sales will therefore be shown as a figure exclusive of VAT. This is the same for a VAT registered business however, payment of the VAT on sales will be calculated and included in a cash flow forecast.

In a profit and loss forecast, all figures are shown net of VAT. However, in a cash flow forecast, figures are calculated to include VAT. If your business is not VAT registered, the goods you buy will include an element of VAT. You cannot reclaim the VAT which therefore means the goods are more expensive. This is the same for all costs that incur a VAT charge. Whilst goods may appear more expensive because you cannot reclaim the VAT, the business is effectively charging a higher price because 20% VAT of the sales value is not being paid to the Government.

In simple terms, if your supplier issues you an invoice for goods to the value of £100 plus VAT, on the Profit and Loss forecast you will enter £100 but on the cash flow forecast you will issue the full value of £120 (ie. Including VAT) as this is the cash you will have to pay to the supplier.

2. Reflecting the timings of your business

Outside of VAT calculations, the main difference between the profit and loss forecast and cash flow is timing. Depending on the industry sector, most businesses buy and sell goods with an agreement to pay within a specified timescale e.g. 30 days from date of invoice. This means the goods are invoiced and delivered but the business does not pay for or receive the funds for a further 30 days. The cash flow forecast must reflect this.

To expand this a little further, goods sold in January will be paid for in February, depending on the terms of trade. Whilst the profit and loss forecast would therefore show the sale or purchase transaction, the cash flow forecast will not record the receipt or payment of this transaction until the following month.

For any business, there is always a danger that it is profitable, but cash starved due to the timings surrounding the receipt of and payment for goods. This is important to understand as decisions are generally made with suppliers and customers that can have massive cash flow implications.

To look at an example of this, let’s say that your business manufactures a product.

- You purchase the raw materials but are not provided with any credit facilities.

- You sell the finished product into a large supermarket chain. Their terms of trade are payment 90 days from month end. This could mean that your business must wait up to 120 days to receive payment and yet, every month must find the money to pay for the raw materials.

As you can imagine, the deal could be profitable BUT, the impact on cash flow is potentially disastrous. With a deal like this, it is important to calculate your projected cash flow including the cost of financing the contract to supply the goods into the supermarket chain, as it may be that the actual profit on this is a lot smaller than originally thought.

If we explore this example further and add values to the words, you purchase raw materials at £5,000 per month and sell the goods at £8,000. While there is a profit of £3,000 per month, there is a cash flow implication. Raw materials are paid for every month which means paying out £20,000. In month four, you receive £8,000 from the first month’s sales. Your business must therefore fund the cash gap of £12,000.

Often, it’s the deals with the bigger businesses who require substantial payment terms, that are the cause of the failure of a business. The saying “cash is king” is so true. Looking at the long list of business failures, the biggest contributor in the reasons why a business fails is running out of cash. This is why it’s so important to spend time on the cash flow forecast, accurately working out your projections.

3. Including the interest on any loans or overdrafts

In a profit and loss forecast, it is correct to include the interest on any loans or overdraft. With loans, the capital is NOT included on the profit and loss forecast but is included alongside the interest in the cash flow forecast. All interest is cash moving out of the bank and therefore it makes sense to be included.

4. Don’t include depreciation

Depreciation is included on a profit and loss forecast, but not on a cash flow forecast. Depreciation is the writing down of a fixed asset such as a machine. This may be written off at a rate of say 15% per annum, although your accountant will help you decide what percentage to use. This is included in the profit and loss forecast as it is considered a cost of the machine (it’s covering wear and tear). This figure will also be included in a balance sheet. But, as there is no movement of physical money, it is not included in the cash flow forecast.

5. You need your profit and loss forecast to create your cash flow forecast

When writing a cash flow forecast, it is important to refer to your profit and loss forecast to ensure you have included most items except for those mentioned above. If the business is VAT registered, then the VAT must be added into the numbers. If not then all costs will still incur the VAT element but your business will be unable to claim it back.

With each line, you need to consider either when the money will be received or when the payment must be made. For a VAT registered business, you also need to show how much VAT is to be paid and when it is paid.

As mentioned above, if you intend to borrow money by way of a loan, then you will need to show both the capital and interest payments every month. Additionally, the loan funds being received into the business together with the money spent on the goods e.g. payment for a machine should be included. If you intend to borrow money from a bank, get a quote to include capital and interest so that your figures can be accurate. Please ensure you ask about setting up fees to include in your forecast so that you are being thorough.

One of the most critical things you must do before handing in your cash flow forecast is to test. If your payment terms are 30 days from the end of the month, ensure you have correctly worked your numbers based on this and not calculated 30 days from the date of invoice. They are completely different and can massively impact the borrowing requirement.

It’s also important to test how robust your business will be if your customers do not pay on time. Being fair, it’s highly unlikely they will and one of the most important tasks you may need to perform in a month is keeping on top of your customers and their payments.

I recommend you undertake a variance test where you allow 45 days of your usual terms for payment. Re-calculate your numbers and check the implications to your cash flow through late payment:

- How much extra do you need to borrow because of late payment?

- Can you build this into your pricing?

- How much does this change the risk of setting up your business?

- What are the chances of obtaining bank or finance support based on these numbers?

Whatever the outcome of this exercise, do NOT get rid of the evidence. Personally, I would include this within a business plan. A second cash flow forecast demonstrates that you have seriously thought about your business in trading terms and have taken the time to apply this “what if” scenario. Chances are, a financier will believe your second set of numbers more than the first because they know and understand the business climate and how difficult trading is, especially getting paid for the goods or services you have sold.

Summary

A cash flow forecast is an important document. It helps you to understand the movement of your cash throughout the year, based upon your forecast sales. Cash flow takes into consideration the timescales for payments to be made and monies to be received. It is a good barometer of whether the business will require additional funding to help pay the bills, staff, suppliers on time allowing for when funds should be received by your customers.

As the business grows and either customer or supplier trading terms change, it is important to re-draw your forecast. This may help you arrange additional funding early rather than make a request of your bank at the last minute, which will surely be looked upon as a bad mark against your reputation and business acumen.

Take the time to get this right, own your cash flow and be thorough with your costings. Attention to detail is a must when forecasting for your business. Please don’t leave this to your accountant unless you agree to spend the time with them dissecting every line to provide the most accurate document you can. Your business life may depend on both your profit and loss and cash flow forecasts so it is worth taking as much time as you can allow, to get it right. Even when you have done this, a sudden change, whether good or bad, can throw a spanner in the works, altering the projections, and means you quickly need to do the cash flow forecast again.

Understanding forecasts is a MUST for any business owner. They are not something to write for a lender and then throw into the drawer and forget about them. Whilst you will no doubt need to focus on developing your business, answering queries and hopefully building sales, there is a saying that “cash is king”. It is so true. If your business runs out of cash, it can go bust, despite being profitable. You must therefore watch the cash very carefully and ensure you have the funds in place to pay the bills as and when they fall due. A cash flow forecast is essential for this.

So, how can Yell help your business?

Yell has an extensive library of great business articles to help you achieve more with your business whether you’re in the process of starting your business or already running an established business. There are a wealth of money-making ideas available to you, written by established consultants, writers and business owners. New articles are released every week to ensure the information is up-to-date and still relevant.

There are tools to help with online research and it’s worth taking the time to get to know the many ways in which Yell can help your business.

Here are a few other links you may find useful…

Why Yell? – https://business.yell.com/why-yell

Available solutions – https://business.yell.com/solutions

Helping you succeed online – https://business.yell.com/solution-advisor

This article was originally published on 05 July 2017, and updated on 03 September 2020