Welcome new freelancers, we’re back with the next instalment in our 3-part series about starting a freelance business. If you want to get up to speed with part 1, you can check it out here.

Welcome new freelancers, we’re back with the next instalment in our 3-part series about starting a freelance business. If you want to get up to speed with part 1, you can check it out here.

EDIT: Part 3 is now available here.

All caught up? Now we’ll get on with the essential business of dealing with pricing and accounts.

Pricing your Services & Working with Expenses

The first step in working out your pricing is to work out all of your expenses to come to a minimum daily or hourly rate. Look at all of your personal outgoings for the past month – food shopping, energy and telecoms bills, debt repayments, rent/mortgage; basically everything you spend money on to live each month.

Next, you need to look at the average monthly outgoings for your business. These will vary depending on the nature of your business, but it may include things like software subscriptions, certain licences and memberships, rent/mortgage if you have business premises, travel expenses, stock, insurance and so on, and add these up to a monthly figure. If you’ve had to spend money on a large one-off purchase for your business (or are planning to) such as tools or a new computer, divide the cost of this purchase by 12, and add it to your monthly total so you can aim to make that money back within your rate. You may also want to incorporate a desired amount of profit that you’d like to make each month at this point.

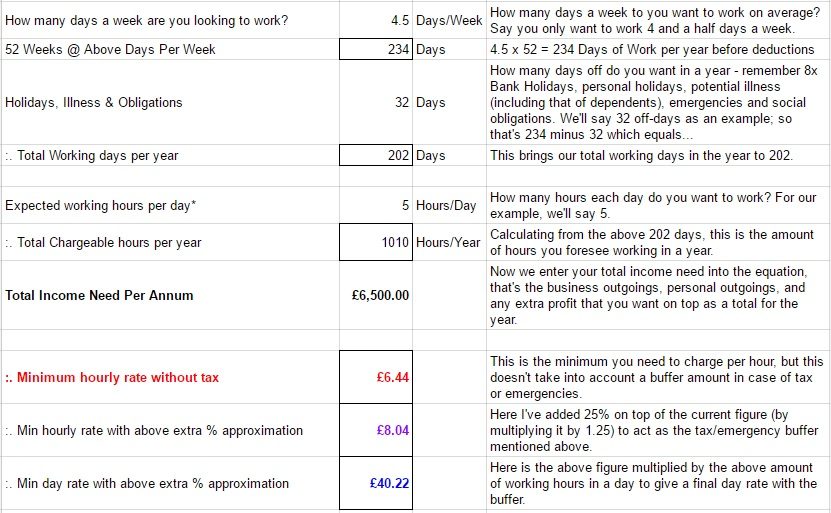

Now add up both your personal monthly total, your business monthly total and the (optional) desired amount of profit. This is the base amount that you need to make each month. Multiply it by 12 for a yearly figure, now we’re going to rely on some spreadsheet magic.

Here’s a spreadsheet taking you through all of the steps – follow the rightmost column for an explanation. Click on it for an editable Google Sheet version for you to put your own figures in. Please save it to your own Google Drive and don’t change the fields with the border, they’ve got the all-important formulas in!

If you’d rather work in terms of a weekly or daily rate, then by all means work do that. And remember that this is just a MINIMUM, you can (and probably should) charge extra. Also, just because you know your hourly, daily or weekly rate doesn’t mean you have to charge by the hour/day/week. If you’d rather charge by the project, you can bear your minimum rate in mind when considering how long that project is going to take you. When pricing on a whole project, remember other elements such as the value and convenience that your involvement will mean for the client, any uncertainty or risk that this client may cause, or any rush fees if a tight deadline is required. Research average industry rates when working on your pricing, and consider the general going rate for someone doing what you do at your level of expertise. The best option here is to scour online resources for the going rate within your niche.

Further Reading

- Essential tips on how much to charge for your freelance work by Katy Cowan for CreativeBoom

- How do I calculate my freelance design rate? by Patricia van den Akker for The Design Trust (with some sound advice for all freelancers, not just designers)

Managing Books & Expenses

Disclaimer: The information presented here is intended only as a basic guide. If you have any specific queries, or require more up to the minute information, please refer to the boffins over at HMRC.

The first thing that may take a little getting used to is to start saving and separating all of your invoices and receipts (for allowable business purchases only, HMRC provide a guide here to what expenses are allowable). This is where a surprising amount of people have trouble. They’ll keep all of their receipts somewhere without separating them from personal stuff, or sometimes not get a receipt at all, and when it comes to tax return season they go into a mad frenzy to get everything in order. I implore you – keep receipts safely and separately as soon as you return home or to the office! Some people like to keep them in envelopes with the month written on to put the appropriate receipts in; others staple them to a piece of paper and put them in order in a ring binder, some use concertina files labelled with each appropriate month of the financial year, you may prefer something else entirely – please work out a system that’s most practical for you.

Because I’m an organisation nerd, my receipts and invoices get put on record as soon as possible after a purchase is made, because that’s what works for me. However, you may wish to enter things at the end of every week or month. As long as any receipts are kept organised before and after they are entered, use whatever system works for you as long as it works. If you come up with a system that’s easy but you can’t keep to it or it throws out the wrong figures at the end of the month, it’s worth putting in that extra bit of effort to come up with something more functional.

If I were to discuss all of the bookkeeping options that are out there, this article would possibly become the longest in Yell history. Check out these resources to help find a system that suits you:

- Single Entry Bookkeeping from Beginner Bookkeeping

- Double Entry Bookkeeping Explained by GPASolutions1

- A free basic bookkeeping spreadsheet from Poetic Mind

- A simple bookkeeping template from TaxSimple

- A few Excel templates from Business Accounting Basics

- And finally some general organisation advice from Biff Raven-Hill

One quick tip I was taught about receipts printed on thermal paper (the norm for till and card receipts these days); if you’ve ever found a receipt that’s over 6 months or so old, you may notice that it will have faded considerably. Therefore, it makes sense to photocopy any receipts when they’re “new” and staple the original to the photocopy for record keeping. Alternatively, if you prefer to work digitally, you can of course scan them and save them on your PC or upload them to a cloud storage service.

If your business incomings and outgoings are fairly simple, you needn’t invest in any accounting software. Whether you kick it old-school with a physical balance book or use a spreadsheet you’ll be alright as long as you keep everything up to date. Put simply, you need to be able to keep tabs on the following (more information on HMRC):

- Your business’ total outgoings each financial year (allowable expenses only)

- Your total incoming funds for the business each financial year

- Your total “wage” paid to yourself from the business each financial year

- Any income from other employment within the year (refer to your P45 or P60)

- If you’re VAT registered, you will need to keep VAT records

- If you employ people, you will need to keep PAYE records

Phew! Now that was a lot of money talk. Don’t worry, we’re on to something a bit more interesting next week, looking at your business processes and the types of business you can own, and looking at a few general nuggets of advice.

EDIT: Part 3 is now available here.

[bctt tweet=”New to freelancing? Check out Part 2 of Yell Business’ comprehensive guide…” username=”yellbusiness”]

Do you have any other money management tips for our new startups out there? Did you have any awesome bookkeeping advice when you were starting out? If you’re a newbie yourself, what do you want to know the most about the accounting side of things? Please share your thoughts down in the comments!